Zero-Based Budgeting 101: A Simple Guide to Budget Every Dollar

Ever wonder where all your money goes by month’s end? Zero-Based Budgeting (ZBB) can change that. In this guide, you’ll learn how to plan every dollar with purpose so your spending, savings, and goals finally work together. I’ll also show how tools like my FitBudget app make it simple (and private) to stay on track.

What is Zero-Based Budgeting?

Zero-Based Budgeting (ZBB) means deciding exactly how to use your income before the month even begins. By the end of your plan, your total income minus all expenses, savings, and debt payments should equal zero. That does not mean spending every penny. It means giving your money clear direction. Some of it goes toward bills and essentials, while the rest supports goals like savings, investments, or debt reduction.

Nothing sits idle. Each portion of your income has a defined role, covering rent, groceries, emergency savings, or a bit of fun. When you plan this way, you stay in control and your money works toward what matters most instead of slipping away unnoticed.

Think of it this way:

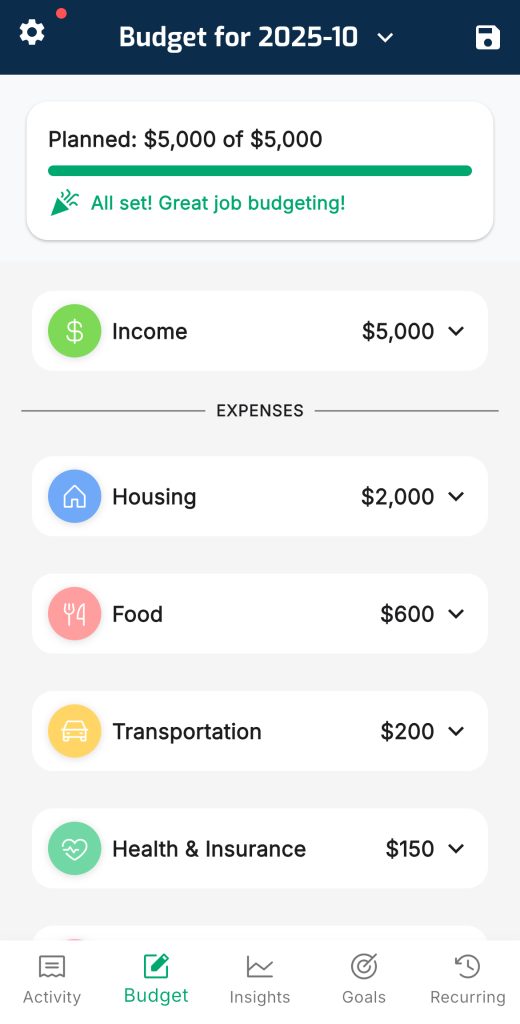

If you earn $5,000 in a month, you will distribute that entire amount across all your needs and goals until none remains unassigned.

That could look like $2,000 for housing, $600 for groceries, $400 for savings, $300 for debt payments, $200 for transportation, $150 for insurance, $100 for emergencies, and $250 for leisure.

If any funds are left over, you simply give them a job such as boosting savings or investments so your plan balances perfectly to zero.

How is this different from a traditional budget?

Traditional budgets often carry over last month’s numbers or leave a general cushion unplanned. A zero-based budget resets every month. You build your plan from scratch and evaluate each expense with intention. Nothing operates on autopilot. You stay fully engaged in deciding where your money goes.

This approach is similar to the envelope system your grandparents might have used, where you physically divided cash into envelopes for rent, groceries, and fun until nothing remained. Zero-based budgeting builds on the same idea of giving every dollar a job, but with a monthly planning format that works whether you use a notebook, spreadsheet, or an app. The method keeps you fully intentional with every dollar so nothing slips through the cracks.

How to Start a Zero-Based Budget

Getting started with zero-based budgeting is straightforward. Follow these basic steps to create your first zero-based budget:

By following these steps, you’ve created a clear plan for every dollar. That foundation gives you full visibility and control over your money. Now let’s look at why this method works so well in practice.

Why Zero-Based Budgeting Works (Benefits of ZBB)

This budgeting approach may take a little more effort upfront, but it delivers powerful results. It keeps you aware of your spending, aligned with your goals, and confident that every dollar is doing something meaningful. Here are some of the key benefits:

- Full Awareness of Your Money: This approach helps you see exactly where every dollar goes. That awareness is powerful because it reveals wasteful habits you might overlook. Maybe you are paying for streaming services you rarely use or spending more on takeout than you realized. With a clear plan, you can spot these leaks and make intentional choices. Think of it as turning on the lights in your financial house. No more money disappearing into the dark.

- Alignment with Your Goals: A zero-based plan helps you budget with purpose. You decide how much to save, invest, or put toward debt before the month begins. It promotes the idea of paying yourself first, making savings and long-term goals a priority instead of an afterthought. Over time, this builds momentum and keeps your spending aligned with what truly matters.

- Guilt-Free Spending (because it’s planned!): You can still enjoy life while following this approach. It is not about restriction but about balance. If you set aside $50 for coffee or $100 for entertainment, you can enjoy those things without guilt because they are part of your plan. This method gives you permission to spend intentionally while keeping your essentials and savings protected.

- Immediate Course-Correction: Regular check-ins keep you on track. Many people review their budget weekly or every few days to see how things are going. If one category starts to run high, you can move money from another before it becomes a problem. This proactive habit prevents surprises and keeps you in control.

- Prevents Overspending and Debt: Because every expense must fit within your income, you avoid spending money you don’t have. It creates built-in discipline. You can’t plan $5,000 in expenses if you only earn $4,000. The math forces you to make adjustments early. Over time, this breaks the cycle of credit card reliance and encourages smarter financial habits month after month.

No system is perfect

The only real challenge with Zero-Based Budgeting is the effort it takes upfront. You will spend time each month reviewing your categories and tracking expenses. For those with variable income, it might take a little practice. Freelancers or hourly workers can use a conservative estimate or last month’s average to build stability.

The good news is that it gets easier. Once you build the routine, it becomes second nature and the payoff is worth it. A recent survey found that 86% of people who budget regularly say it helped them get out of debt or stay out of it. Being intentional with your money is one of the simplest ways to create lasting financial peace.

Tips for Zero-Based Budgeting Success

To make zero-based budgeting work for you in real life, keep these tips in mind:

- Budget for every expense: Do not overlook small or occasional costs. If something does not occur monthly, such as a car insurance bill every six months or an annual subscription, still plan for it. For example, if your car insurance costs $600 twice a year, save $100 per month in a “car insurance” category. When the bill arrives, the money will already be there. You will get the best results when you anticipate upcoming costs and include them in your plan.

- Handle irregular income smartly: If your paychecks vary, base your budget on a conservative estimate of your income. Use last month’s income as a guide, or plan around your lowest earning month. When income is higher, allocate the extra toward future expenses or savings. This approach builds a natural buffer and prevents surprises.

- Build an emergency fund: Life happens. Cars break down and medical bills appear. Include a category for emergency savings in your budget, even if you start small. Your emergency fund protects you from unexpected costs and helps you stay consistent. Knowing you have a cushion makes it easier to stick with your plan when surprises come up.

- Be flexible and kind to yourself: During the first few months, expect to make adjustments. Maybe you underestimated groceries or forgot about a birthday gift. That is normal. The zero-based method allows flexibility as long as you reassign money from another category. The goal is progress, not perfection. Over time, you will get better at predicting expenses and managing your categories.

- Use tools to simplify the process: You can absolutely do zero-based budgeting with pen and paper or a spreadsheet, but there are also great tools to help. Which brings us to the next point…

Using a Budgeting App to Simplify Zero-Based Budgeting

One of the best ways to stay consistent with Zero-Based Budgeting is to make it simple. A good budgeting app can do the heavy lifting, track your categories, and remind you when you are close to your limits. But not all budgeting apps are created equal. Many try to do too many things at once, becoming cluttered and confusing. Some even require you to sign up or link your accounts before you can try them.

As a busy parent and professional, I found that frustrating. I wanted an app that focused only on budgeting and respected my privacy.

In fact, that is why I built FitBudget—a simple, private budgeting app designed specifically for Zero-Based Budgeting. I had tried other apps that offered dozens of features I did not need or that forced me to connect every bank account right away. I wanted something better.

FitBudget takes a different approach:

- Simplicity first: I built FitBudget specifically for Zero-Based Budgeting, not as a generic expense tracker that tries to do everything. The interface is clean and focused, so you can plan your budget, log expenses, and make quick adjustments without getting lost in unnecessary charts or menus. It feels as straightforward as using a notebook but with smarter tools that save time.

- Privacy by design: Your data stays on your device. FitBudget works offline and never asks you to create an account or upload your financial information to the cloud. I built it this way because I believe your budgeting data should stay 100% private and secure. No sign-ups, no ads, and no selling of your information. FitBudget exists to help you manage money better, not to profit from your data.

- Built for busy lives: The app is optimized for speed and simplicity. You can set up your entire monthly Zero-Based Budget in just a few minutes. If you want automation, FitBudget Pro lets you securely sync bank transactions so expenses log automatically and recurring bills are detected. Those features are optional upgrades. If you prefer manual entry, the free version keeps things simple and hands-on. FitBudget is designed to fit into your day, whether you are managing a household or balancing work and family life.

- Stay on top of goals: FitBudget helps you track your progress and stay accountable. It reminds you mid-month if you are off track and automatically carries over leftover funds to savings or next month’s plan. Every dollar has a purpose, and none slips through the cracks.

There are other apps out there too – some people use You Need A Budget (YNAB) or EveryDollar, which are well-known for zero-based budgeting. Those are solid options, but they can be pricier or have a learning curve (YNAB, for instance, has its own terminology and rules). My advice: use whatever tool you find you’ll actually stick with. The best budget is the one you’ll maintain. If that’s a spreadsheet you love, great! If it’s an app like FitBudget that keeps things simple and private, even better. The goal is to make budgeting as painless as possible, so you can consistently follow through.

Final Thoughts

Learning how to budget with a zero-based approach might feel unfamiliar at first, but it’s one of the best ways to take control of your money. Zero-Based Budgeting is about intention. You tell your money where to go instead of wondering where it went. After a few months, you’ll likely feel less stress about money because every dollar has a plan. Many people even say it feels like they got a raise once they start budgeting. They make the most of every dollar instead of letting any slip away.

I’ve used this method to balance family life, a career, and financial goals, and I can tell you firsthand that it works. It brings clarity, confidence, and peace of mind to your finances. If you’re ready to try it, grab a notebook or download a budgeting app. Create your first zero-based budget and plan every dollar before you spend. You’ll build better money habits with every month that passes.

You have the power to change how you manage money. One plan, one paycheck, one decision at a time. Start today.

Internal Link: Learn more about the FitBudget app if you are looking for a simple, private way to start your zero-based budgeting journey.

External Resource: Want a deeper dive into zero-based budgeting? Check out Investopedia’s explainer on Zero-Based Budgeting for more background on how it originated and its uses . Remember, the key takeaway is giving every dollar a purpose. Happy budgeting, and good luck on your financial journey!